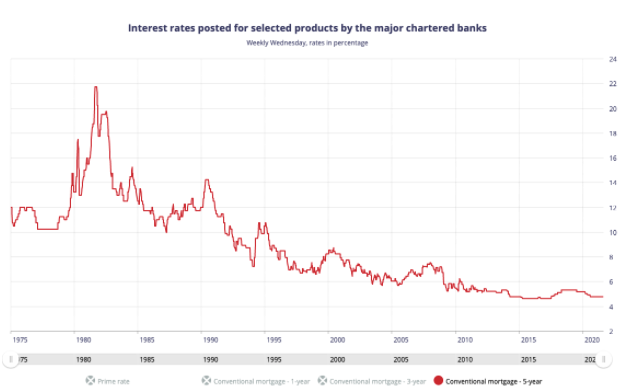

When I first invested in real estate after coming out of university, the interest rates were around 6%. In the 20 years since then, they have never gone higher. It’s been over 40 years since the almost unbelievable interest rates of 20+%.

Graph – Interest rates average posted for conventional mortgages by major Canadian banks from Lowestrates.ca

On March 2nd, The Bank of Canada increased its target for the overnight rate to ½ %, with the Bank Rate at ¾ % and the deposit rate at ½ %. This was the first increase in borrowing rates since 2018 and was expected. It was perhaps surprising that it had not happened sooner.

The 5 major banks have all increased their prime lending rate to 2.7% from 2.45%. which means it will be more expensive to borrow for those looking to purchase a house. However, the qualifying rate hasn’t changed and for someone with a variable rate mortgage of $500,000, it would mean an increase of around $58 a month in payments, which isn’t substantial, for now.

On its own, the interest rate increase is not going to have a real effect on the current real estate market given a number of factors pulling in different directions such as a strong job market that is back to pre-pandemic levels, spring selling season just around the corner and still low but increasing inventory levels.

But with inflation at over 5% and rising, the Bank of Canada is expected to increase the interest rate in future months in order to do what it can to meet the 2% inflation target through its monetary policy.

The Bank’s next announcement is scheduled for April 13th. BMO Financial Group chief economist and managing director Doug Porter is quoted “Historically, the Bank of Canada has not tended to fool around once they start raising interest rates. They tend to go on a series of moves when they decide it’s time to start moving on rates, and I didn’t get the sense that they were going to change from that pattern this time either. I would expect them to hike rates again in April and probably the next meeting after that.”

The challenge, as the Bank of Canada also stated in its announcement, is there are a number of other worrying factors with very unknown impacts;

- Invasion of Ukraine

- Rising oil and commodity prices

- Continued supply chain issues

- Financial market volatility

However, CIBC World Markets’ deputy chief economist Benjamin Tal does not see the Ukraine crisis on its own having much economic impact on Canada and he was quoted as saying “The number one impact is on Russia and Ukraine because of sanctions and what’s happening to Ukraine. Then there are Germany and France, once removed. We are twice removed.”

That gives some reassurance but the inflationary impact is different. That is why continued rate increases are almost certain to happen throughout the year.

It is commonly supported by economists like Porter that small steady increases are more likely but that it will take a few to have any serious impact and that it takes about 100 basis points of rate hikes to make a serious impact on the housing market and prices.

There is far more detail that economists will be more than happy to dive into but the message is that it will take some time for the interest rates to have a meaningful impact so the increasing demand and pricing is expected to stay relatively the same this year. Prices are likely to still stay high and continue to climb.

I have written in the past about the impact of inflation on real estate which, together with increased immigration supports the likelyhood that buying property now, if chosen using the right strategy and in the right markets, will not only hold its value but will increase.

Investing in real estate today is still going to offer a great opportunity to grow your nest egg into your retirement and diversify your portfolio and moderate it while the stock market continues to be volatile.

If you would like to understand how real estate could become a part of your retirement planning please book an appointment for an initial conversation https://calendly.com/carleen-su-1

As always, happy investing.

Remember to always plan for the future but live your life today…

Sources: Bank of Canada, Canadian Mortgage Professional, Lowestrates.ca, Calgary Herald, Statista.com , Reuters