Collapsing stock markets, higher gas prices, bigger grocery bills, rising interest rates and a cooling housing market – it’s highly likely that any of you reading this are getting impacted by at least one of these.

Couple this with the latest economic numbers that came out last week, inflation in the May CPI (Consumer Price Index) hitting 7.7%, leaves many of us wondering about what the value of the dollar in our pocket is going to be worth next month, next year and in 10 years.

It even has the Bank of Canada being kept awake at night!

Headline from the Financial Post, June 22nd, 2022. Read the full article here https://financialpost.com/news/economy/high-inflation-keeping-us-up-at-night-says-bank-of-canada-senior-deputy

Carolyn Rogers, the Bank of Canada’s senior deputy governor said “Inflation is too high; it’s hurting Canadians,” Rogers said at a Toronto conference. “It’s keeping us up at night and we will not rest easy until we get it back down to target… That’s why we’re raising interest rates and as we say, we’re raising them quite aggressively.”

A common reaction to this is that higher interest rates must mean real estate is a less attractive option either to own or hold as an investment asset. For people who were struggling to buy property recently that may very well seem to be or actually be the case.

But the more experienced real estate owners and investors know that there is more work to be done in understanding the impact that higher interest rates may have.

When you take the time to do a little research to help you understand what’s going on, then you can create a plan for managing these more difficult times, real estate investing can still make a lot of sense.

Part of that is realizing that with this level of inflation, your income is not going to keep pace, and basic saving isn’t either. In fact, your dollar is devaluing every day that it sits in the bank.

What you need to look at is long-term savings with assets that can produce income for you, e.g. real estate but with a caveat. Real estate in areas where the demand will continue to outpace supply.

Canada has recommitted to positive immigration AND to playing catch up on the numbers that were missed because of the pandemic. That will mean over 400,000 new Canadians a year coming into a country for the next several years.

In Alberta, this will mean around 60,000 new immigrants each year. The challenge is that only approximately 3,000 new houses are built each year, leaving a considerable housing shortfall, which has been the case across the major cities in Canada for years. In other words, demand for housing will continue to outpace supply.

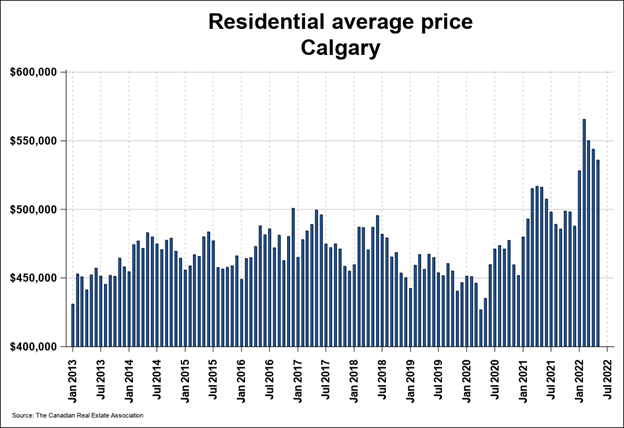

That is why if you look at real estate prices for example in Calgary historically over the last 10 years there are always highs and lows but the overall trend is up.

The 50 and 100-year trends are similar.

This can mean that investing in rental real estate will not only likely appreciate over the long term but at the same time, you are receiving income each month, helping you pay down interest and principal on your investment.

The key is making that plan. Here are 3 steps you will want to follow:

- Set your investing goals and expectations. What do you want to achieve and what are the time horizons? Remember this is normally a longer-term investment so if your horizon is short, there are other active real estate investing strategies that can work better.

- Crunch the numbers. Take time to understand the opportunity, do the analysis or have an experienced real estate investor assist you, and create a detailed breakdown including unexpected costs and vacancies.

- Factor in some wiggle room. Given the headlines and bankers’ comments and predictions, interest rates will be rising for some time to come. Make sure you add this into your equations and that the real estate property still has a good positive cash flow. You should never look to try and make your money only on the appreciation.

A word of caution, with the media headlines and immediate instances like the next time you fill up your car the temptation can be to get caught up emotionally in all of this.

But if you take time to step back, breathe and look at the data real estate investing can still be a way to build generational wealth for you and your family.

If you would like to have a complimentary, discovery discussion about your investing goals and how real estate might be able to factor into them please reach out and let’s connect!